Introduction

Reading trading charts correctly is one of the most important skills in forex trading. Professional traders rely on charts to identify trends, predict price movements, and manage risk effectively. With its intuitive WebTrader platform, Fintana provides traders with powerful charting tools designed for both beginners and experienced traders.

This guide explains how to read charts on Fintana like a professional—step by step—using proven technical analysis techniques.

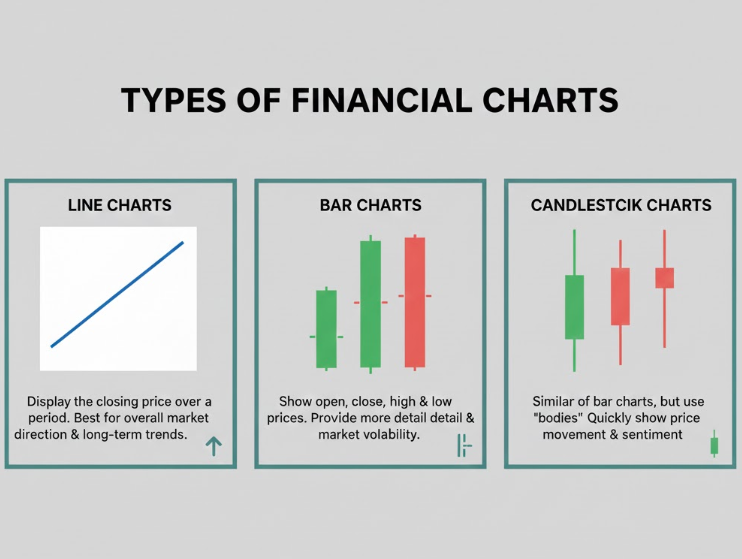

Understanding Chart Types on Fintana

Fintana’s trading platform supports multiple chart types, each serving a different trading purpose:

Line Charts

Line charts display the closing price over a selected period. They are best used to identify overall market direction and long-term trends.

Bar Charts

Bar charts show the opening, closing, high, and low prices. They provide more detail than line charts and help traders understand market volatility.

Candlestick Charts

Candlestick charts are the most popular among professional traders. Each candlestick clearly shows market sentiment, making it easier to spot reversals and continuation patterns.

Choosing the Right Timeframe

Timeframes play a critical role in chart analysis. On Fintana, traders can switch between multiple timeframes depending on their strategy:

- Short-term traders often use 1-minute to 15-minute charts

- Swing traders prefer 1-hour to 4-hour charts

- Long-term traders analyze daily and weekly charts

Professional traders often use multiple timeframes to confirm trends and entry points.

Identifying Trends Like a Pro

Trend identification is a core skill in technical analysis. On Fintana charts, trends fall into three categories:

- Uptrend: Higher highs and higher lows

- Downtrend: Lower highs and lower lows

- Sideways market: Price moves within a range

Using trendlines on the platform helps traders visually confirm trend direction and avoid trading against market momentum.

Using Key Technical Indicators

Fintana offers a wide range of built-in indicators that help traders analyze price action:

Moving Averages

Moving averages smooth price data and help identify trend direction and potential support or resistance levels.

Relative Strength Index (RSI)

RSI measures market momentum and highlights overbought or oversold conditions.

MACD

The MACD indicator helps traders spot trend changes and momentum shifts early.

Professional traders typically combine two or three indicators rather than relying on just one.

Support and Resistance Levels

Support and resistance are essential concepts in chart reading:

- Support: A price level where buying pressure tends to stop declines

- Resistance: A price level where selling pressure limits upward movement

By drawing horizontal lines at key price levels on Fintana charts, traders can plan entries, exits, and stop-loss placement more effectively.

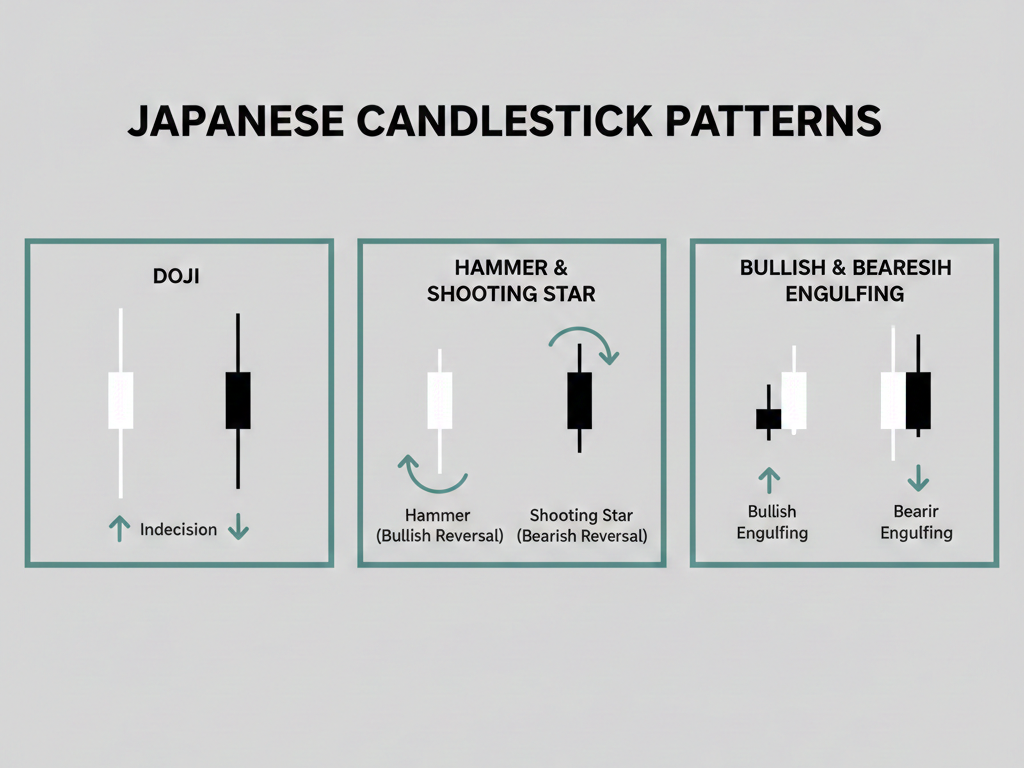

Recognizing Candlestick Patterns

Certain candlestick patterns appear repeatedly across all markets. Common patterns traders watch for include:

- Doji

- Hammer and Shooting Star

- Bullish and Bearish Engulfing

These patterns, when combined with indicators and trend analysis, can signal high-probability trade setups.

Applying Risk Management on Charts

Professional chart reading is not just about entries—it’s also about risk control. Fintana allows traders to place:

- Stop-loss orders directly on the chart

- Take-profit levels based on technical targets

This visual approach helps traders maintain discipline and protect capital.

Final Thoughts

Learning how to read charts properly takes practice, but the right platform makes a significant difference. With advanced charting tools, customizable indicators, and a clean interface, Fintana gives traders everything they need to analyze markets confidently.

By mastering chart types, timeframes, indicators, and price patterns, traders can approach the markets with a professional mindset and make more informed trading decisions.